28+ mortgage interest and taxes

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Ad Compare the Best Home Loans for February 2023.

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

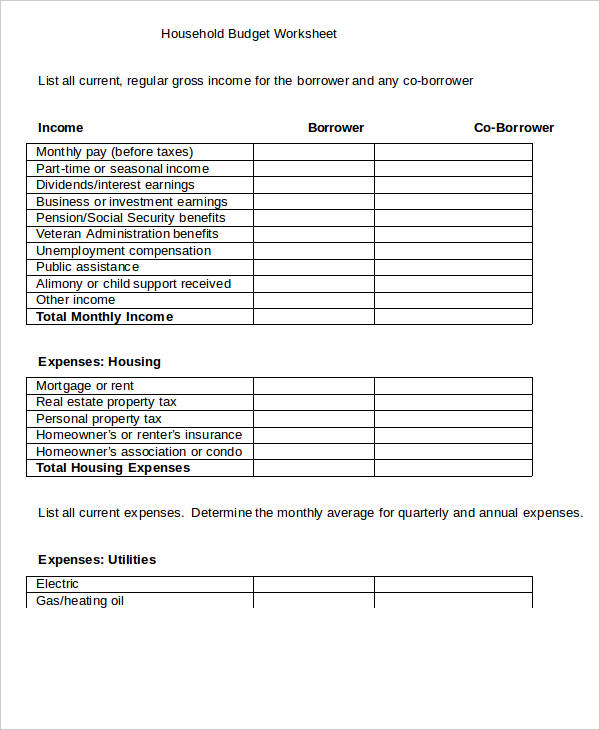

The amount of money you borrowed.

. Web 15 hours agoA 15-year fixed-rate mortgage of 100000 with todays interest rate of 632 will cost 861 per month in principal and interest. Discover Helpful Information And Resources On Taxes From AARP. Apply Get Pre-Approved Today.

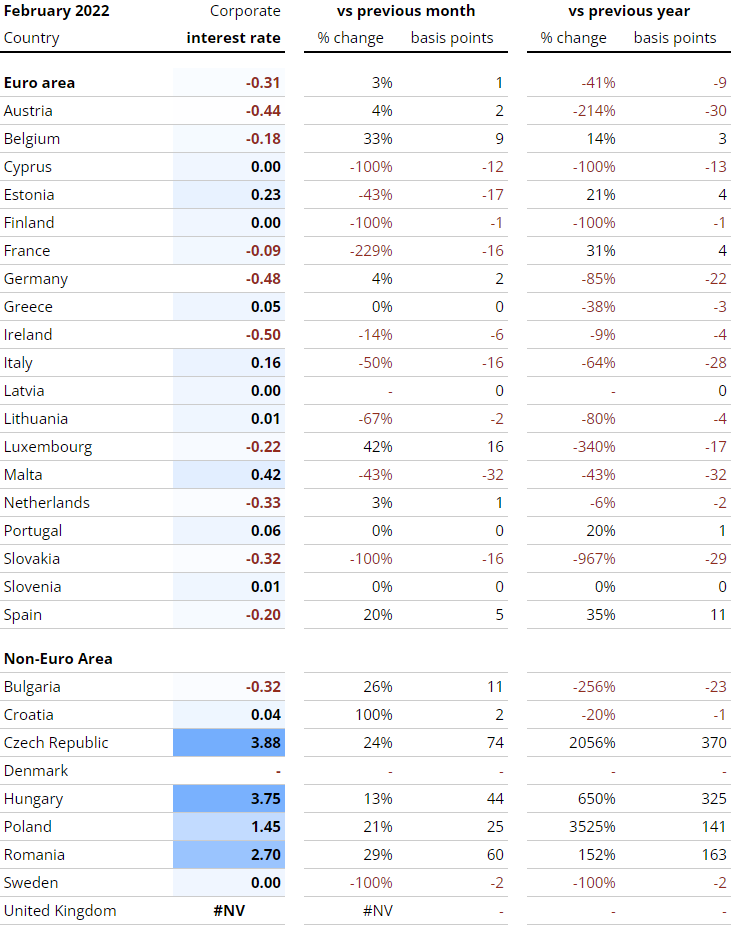

See If You Qualify To File 100 Free w Expert Help. Over the life of the loan you. A basis point is equivalent to.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web 13 hours agoA year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

Web Homeownership comes with many perks one of the biggest being the mortgage interest tax deduction. Additionally for tax years prior to 2018 the. Web To take the mortgage interest deduction youll need to itemize.

16 2017 then its tax-deductible on mortgages. Our Tax Experts Will Help You File Fed and State Returns - All Free. He paid 19100 in mortgage interest in 2022 as shown on his 1098 form.

Web One of the rules you may hear as a homebuyer is the 2836 rule or the debt-to-income DTI rule. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web The average interest rate for a standard 30-year fixed mortgage is 702 which is an increase of 19 basis points from one week ago.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you. You decide to wait six months and the interest rate drops to 6 but the same home now costs.

This example does not include additional taxes and fees. Web Basic income information including amounts of your income. Lock Your Rate Today.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Get Instantly Matched With Your Ideal Mortgage Lender. Ad For Simple Returns Only.

According to the US. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web About Form 1098 Mortgage Interest Statement Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the.

Web Is mortgage interest tax deductible. Homeowners who bought houses before. TaxInterest is the standard that helps you calculate the correct amounts.

Treasurys Office of Tax. Web Mortgage Interest - For total mortgage interest paid during the tax year the percentage of mortgage interest that is equal to the percentage of the year the. Web Aaron is a single taxpayer who purchased his home with a 500000 mortgage.

Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules. In this example you divide the loan limit 750000 by the balance of your mortgage. A basis point is equivalent to 001 The most.

This rule says that your mortgage payment shouldnt go over 28 of your monthly. Web Most homeowners can deduct all of their mortgage interest. Web 14 hours agoThe 30-year fixed-mortgage rate average is 701 which is a growth of 16 basis points compared to one week ago.

Itemizing only makes sense if your itemized deductions total more than the standard deduction. The cost of the loan. Web The traditional monthly mortgage payment calculation includes.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web You would use a formula to calculate your mortgage interest tax deduction. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Walldorf Capital Ventures Multifamily Apartment Investor Self Employed Linkedin

Mortgage Interest Tax Deduction Smartasset Com

Mortgage Interest Deduction Bankrate

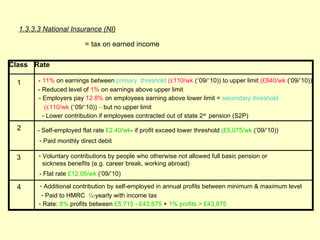

Cemap 1 Final Copy

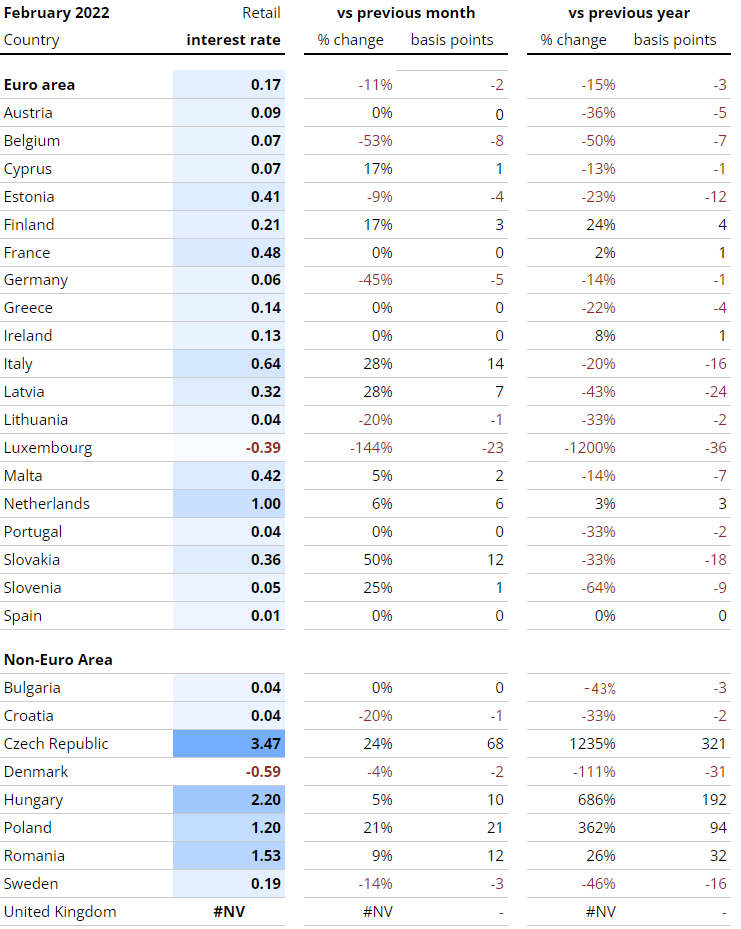

Interest Rates Explained By Raisin

Ex 99 1

Mortgage Interest Tax Relief Changes Explained Taxscouts

28 Sheet Templates In Word

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Broker In Coffs Harbour Sawtell Woolgoolga Mortgage Choice

Cemap 1 Final Copy

Interest Rates Explained By Raisin

Sbi Festive Bonanza For Home Loan Customers Zero Processing Fees Up To 0 30 Discount On Interest And More The Financial Express

Calameo The Azle News

28 48 Acres Lake Orange Rd Hillsborough Nc 27278 23 Photos Mls 2403163 Movoto

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Covid 19 Sba Economic Injury Disaster Loan Money Man 4 Business